Purchase with invoice still most popular in online shopping

Anyone making a purchase on the Internet has a choice of five different payment methods on average at the end of the ordering process. Even though Visa and Co. are popular payment methods and are frequently offered, no variant has yet been able to topple the good old invoice from its throne.

Purchase invoice is one of the most popular payment methods among Swiss customers. Four out of five customers choose this payment method when completing an order (SRF, 2015).

However, not all online stores offer purchase with an invoice. For online retailers, this payment method is usually associated with effort. They shy away from the administrative effort and possible payment defaults by customers. For these stores, however, the market is proving difficult. Many Swiss online stores are increasingly losing customers if they do not offer purchase with invoice. This is reflected in purchase cancellations in the check-out process as soon as customers see that purchase on account is not offered. However, the purchase abandonment rate can be reduced by up to 81% by offering the popular payment method, as a study by the University of Regensburg found out.

The purchase with invoice creates one thing above all: trust. Even large online stores like Zalando rely on this payment method. Swiss customers prefer to have the goods in their hands first and pay for them later, rather than paying for them in advance. In terms of security on the Internet, which many customers want, this continues to be a hot topic, as account data does not have to be disclosed.

How to avoid payment defaults through good risk and dunning management

A possible payment default by the customer is a frequent reason why purchase with invoice is not offered. Good risk management helps you to offer the payment method on account to customers who are able to pay. Various credit rating systems draw on reliable data and enable more precise sorting. These measures save you a lot of trouble.

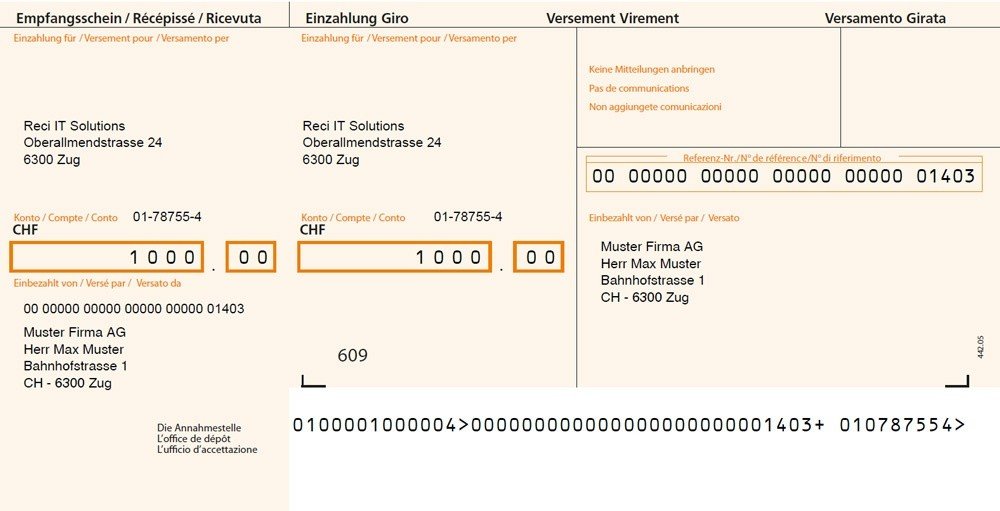

To achieve the highest possible payment morale, proven solutions can be used for a fully automated dunning process. While you take care of processing the order, the customer receives the invoice and the payment slip by mail. If the customer is late with his payment, the order is automatically sent to a dunning run. The reminders are automatically sent by e-mail together with the payment slips or can also be sent in paper form.

What does this mean now for you as an online retailer and what can you do to enable the purchase with invoice for customers?

Above all, this means that you should consider not wanting to offer the purchase with invoice after all. Otherwise, there is a risk of losing customers to other online retailers who offer purchase with invoice. The competition in the online business does not sleep.

If you are repeatedly confronted with purchase cancellations, it is worth thinking about introducing this payment method. After all, in addition to excessively high shipping costs, this is the most common reason why purchases are abandoned. Anyway, it is best to offer as many payment methods as possible in order to reach a larger customer base.

However, if you have a Shopware store in use and are still wondering how and if you should offer purchase with invoice, then we have the right solution for you!

Our Shopware ESR plug-in.

With our ESR plug-in for Shopware, we enable you to generate payment slips with reference numbers and match payments with orders. The payment status management on Shopware is automated with the import of the v11 or XML files. In a simple and uncomplicated way, you keep track of the orders and thus optimize the payment control process. The whole administrative effort is reduced to a minimum.

The ESR plug-in for Shopware and the automated dunning process allow you to focus on your core business.